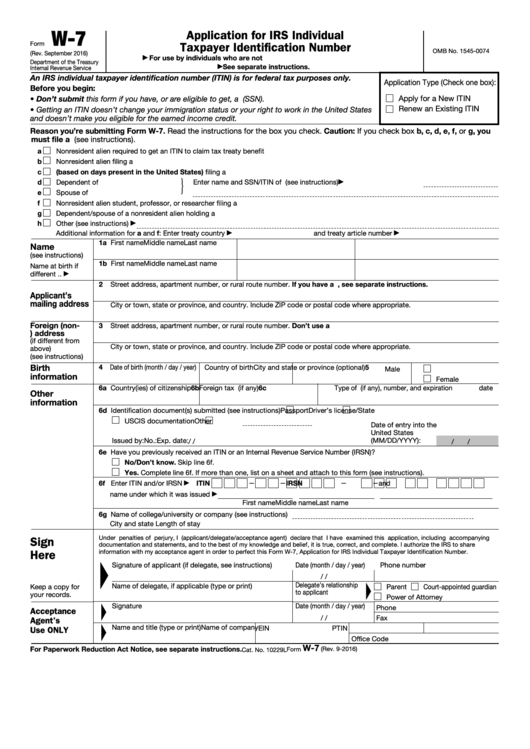

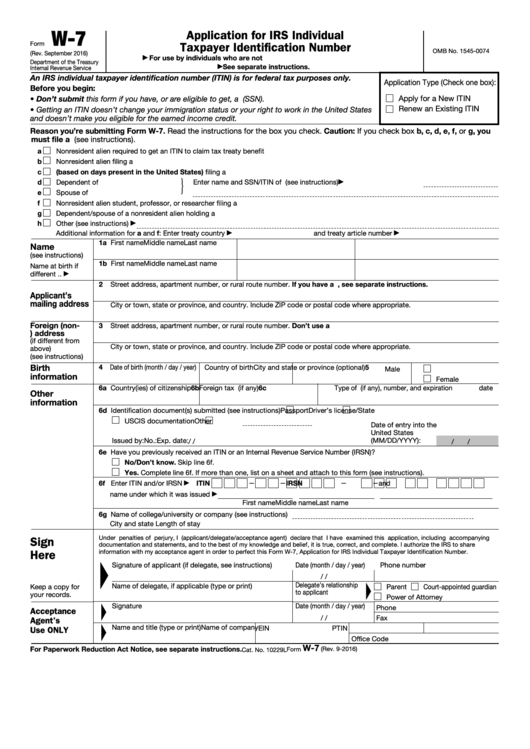

The W-7 form, officially known as the "Application for IRS Individual Taxpayer Identification Number," is a crucial document for individuals who require a tax identification number for various purposes. This form is essential for non-residents, immigrants, and even U.S. citizens who may need to file taxes but do not have a Social Security Number (SSN). In this comprehensive guide, we will delve into the details of the W-7 form, its purpose, and the step-by-step process of obtaining an Individual Taxpayer Identification Number (ITIN).

Understanding the W-7 Form

The W-7 form is used to apply for an ITIN, which is a tax processing number issued by the Internal Revenue Service (IRS) in the United States. Unlike the SSN, which is primarily used for employment and social security purposes, the ITIN is specifically designed for tax-related activities. Here are some key points to understand about the W-7 form and the ITIN:

- Eligibility: The W-7 form is available to anyone, regardless of their immigration status, who needs to file taxes or claim tax benefits in the U.S. This includes non-resident aliens, foreign students, and even U.S. citizens or residents who do not have an SSN.

- Purpose: The primary purpose of the ITIN is to allow individuals to comply with U.S. tax laws and regulations. It enables them to file tax returns, claim refunds, and participate in various tax-related activities, even if they do not have an SSN.

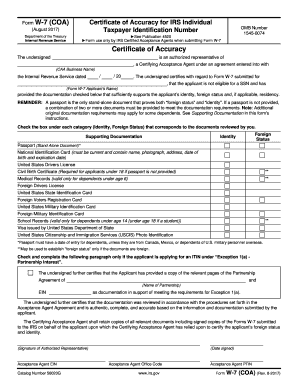

- Document Requirements: To complete the W-7 form and obtain an ITIN, applicants must provide specific documents to prove their identity and foreign status. These documents typically include passports, national identity cards, and other government-issued IDs.

- Processing Time: The processing time for W-7 applications can vary, but it generally takes several weeks to a few months. The IRS aims to process applications within 60-90 days, but delays may occur during peak seasons or due to incomplete documentation.

Step-by-Step Guide to Completing the W-7 Form

Completing the W-7 form accurately is essential to ensure a smooth and successful application process. Here is a detailed guide to help you navigate through the process:

Step 1: Gather Required Documents

Before you begin filling out the W-7 form, make sure you have all the necessary documents ready. The IRS requires specific identification documents to verify your identity and foreign status. Here are the primary documents you will need:

- Proof of Identity: This can include a valid passport, driver's license, or national identity card. If you do not have these, you may use other government-issued IDs, such as a voter's registration card or a military ID.

- Proof of Foreign Status: For non-residents and immigrants, you will need to provide evidence of your foreign status. This can be a valid passport, a visa, or an I-94 arrival/departure record.

- Additional Documents: Depending on your specific circumstances, you may also need to provide additional documents, such as a birth certificate, marriage certificate, or proof of residency.

Step 2: Download and Print the W-7 Form

The W-7 form is available on the IRS website. You can download and print the form directly from their official website. Make sure you have the latest version of the form to avoid any potential issues.

Step 3: Fill Out the Form

Carefully read through the instructions provided with the W-7 form. Pay attention to the specific requirements and guidelines for each section. Here are some key points to keep in mind while filling out the form:

- Personal Information: Provide accurate and complete personal information, including your full name, date of birth, and address. Ensure that your name matches the name on your identification documents.

- Foreign Status: Indicate your foreign status by selecting the appropriate option from the provided list. This will help the IRS determine your eligibility for an ITIN.

- Tax Information: If you are filing a tax return, you will need to provide details about your tax situation. This includes information about your income, deductions, and any tax returns you intend to file.

- Signatures: The W-7 form requires your original signature. Make sure to sign the form in blue or black ink. If you are applying on behalf of a dependent, you will need to provide their signature as well.

Step 4: Prepare Supporting Documents

In addition to the W-7 form, you will need to submit supporting documents to verify your identity and foreign status. These documents should be original or certified copies. Here is a list of commonly required supporting documents:

- Passport (front and back)

- National identity card (front and back)

- Visa or I-94 arrival/departure record

- Birth certificate (for dependents)

- Marriage certificate (if applicable)

- Proof of residency (utility bills, lease agreements)

Step 5: Submit the Application

Once you have completed the W-7 form and gathered all the required documents, it's time to submit your application. You can choose to submit your application in person, by mail, or through an acceptance agent. Here's how to proceed with each option:

In-Person Submission

- Locate the nearest IRS Taxpayer Assistance Center (TAC) or designated acceptance agent office.

- Bring your completed W-7 form, supporting documents, and a copy of each document.

- Present your original documents for verification at the TAC or acceptance agent office.

- They will review your application and provide you with a receipt as proof of submission.

Mail Submission

- Make copies of your completed W-7 form and supporting documents.

- Send the original W-7 form, supporting documents, and a copy of each document to the address specified by the IRS for ITIN applications.

- Include a self-addressed, stamped envelope to receive your ITIN letter and other correspondence.

Acceptance Agent Submission

- Locate an IRS-authorized acceptance agent in your area.

- Schedule an appointment with the acceptance agent to review your application.

- Bring your completed W-7 form, supporting documents, and a copy of each document to the appointment.

- The acceptance agent will review your application and submit it to the IRS on your behalf.

Processing and Approval

After submitting your W-7 application, the IRS will review your documents and verify your identity and foreign status. The processing time can vary, but it typically takes several weeks to a few months. During this time, you can track the status of your application through the IRS website or by contacting the IRS ITIN hotline.

Once your application is approved, you will receive an ITIN letter in the mail. This letter will contain your newly assigned ITIN, which you can use for tax-related purposes. Keep this letter in a safe place, as you may need to provide it when filing tax returns or claiming tax benefits.

Renewal and Expiration

ITINs are generally valid for a period of five years. However, if your ITIN is still valid when you file a tax return, you do not need to renew it. The IRS will automatically extend the expiration date on your ITIN when you file a valid tax return.

If your ITIN is expired or about to expire, you will need to renew it by completing and submitting a new W-7 form. The renewal process is similar to the initial application process, and you will need to provide updated identification and foreign status documents.

FAQs

Can I use my ITIN for employment purposes?

+

No, ITINs are solely for tax-related purposes and cannot be used for employment. If you need an SSN for employment, you must apply for one through the Social Security Administration.

Do I need to submit original documents with my W-7 application?

+

Yes, the IRS requires original or certified copies of your identification and foreign status documents. Make sure to provide the required documents as specified in the instructions.

Can I apply for an ITIN if I am not a U.S. citizen or resident?

+

Absolutely! The W-7 form is available to anyone, regardless of their immigration status, who needs to file taxes or claim tax benefits in the U.S.

Conclusion

Obtaining an ITIN through the W-7 form is a crucial step for individuals who require a tax identification number for various reasons. By following the step-by-step guide provided in this blog, you can navigate the application process with ease and ensure a successful outcome. Remember to gather all the necessary documents, complete the form accurately, and submit your application through the appropriate channel. With your ITIN in hand, you can confidently participate in U.S. tax-related activities and comply with tax laws.